Active.ai Uses AI to Deliver Virtual Assistant Banking Services, Announces $3M Round and Partnerships

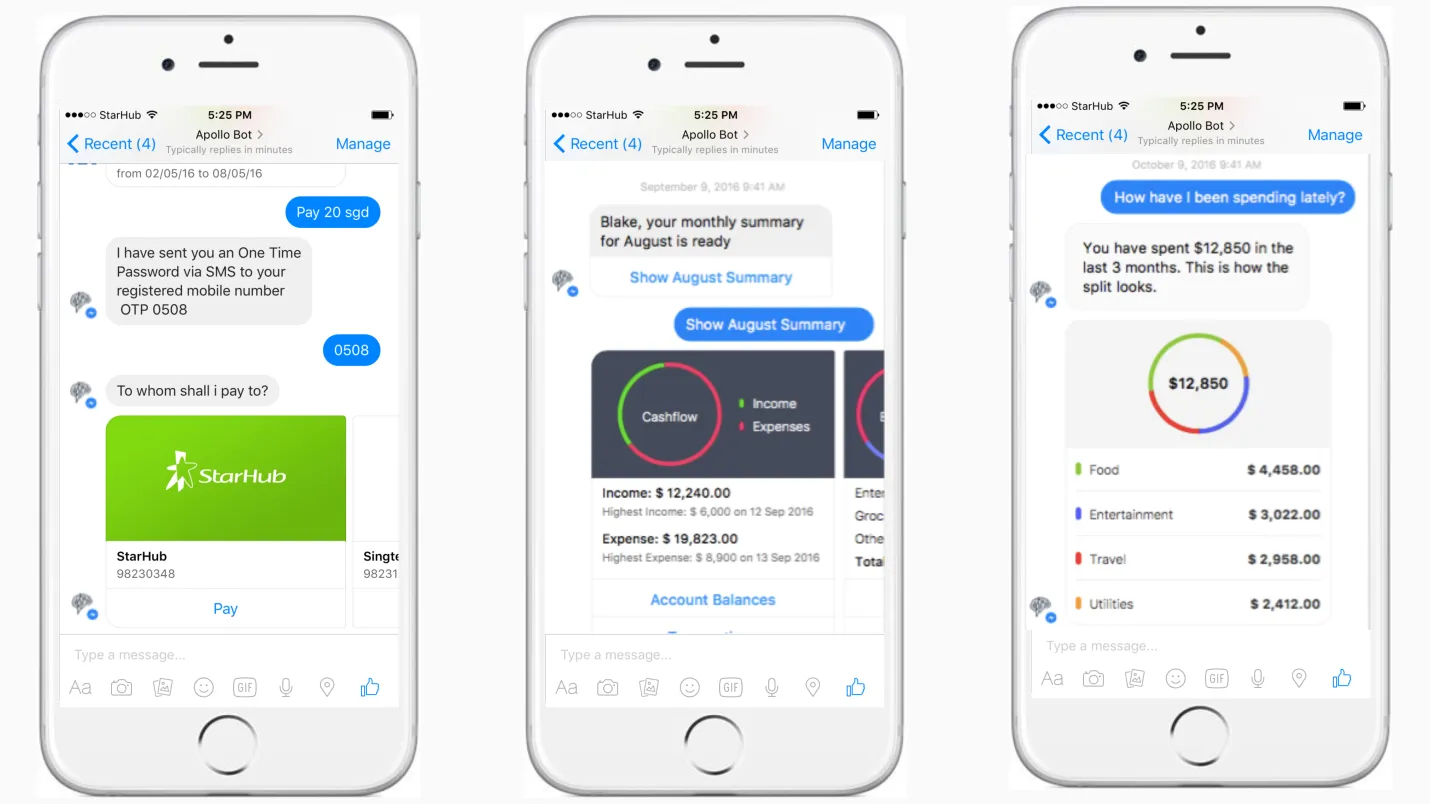

Unlike how most of us predict the outcome of something like US presidential elections (and go wrong), our personal finance and money matters need accurate answers. In this age, where millennials expect everything in four clicks, it is also important to quickly provide those accurate answers and a great customer experience. Chatbots, AI, deep learning are the common techniques used by technology startups to develop a communication channel that would work with the digital generation and provide them with advice, action, and plans – from what type of savings account/banking products is right for them to what type of investments one needs to make to reach their goals. One such startup called Active.ai enables banks to provide conversational banking that involves no browsing, no downloads, and no forms. Just chit-chat with a friendly, intelligent, and tireless bot to get balances, view transactions, make payments, get advice, and much more.

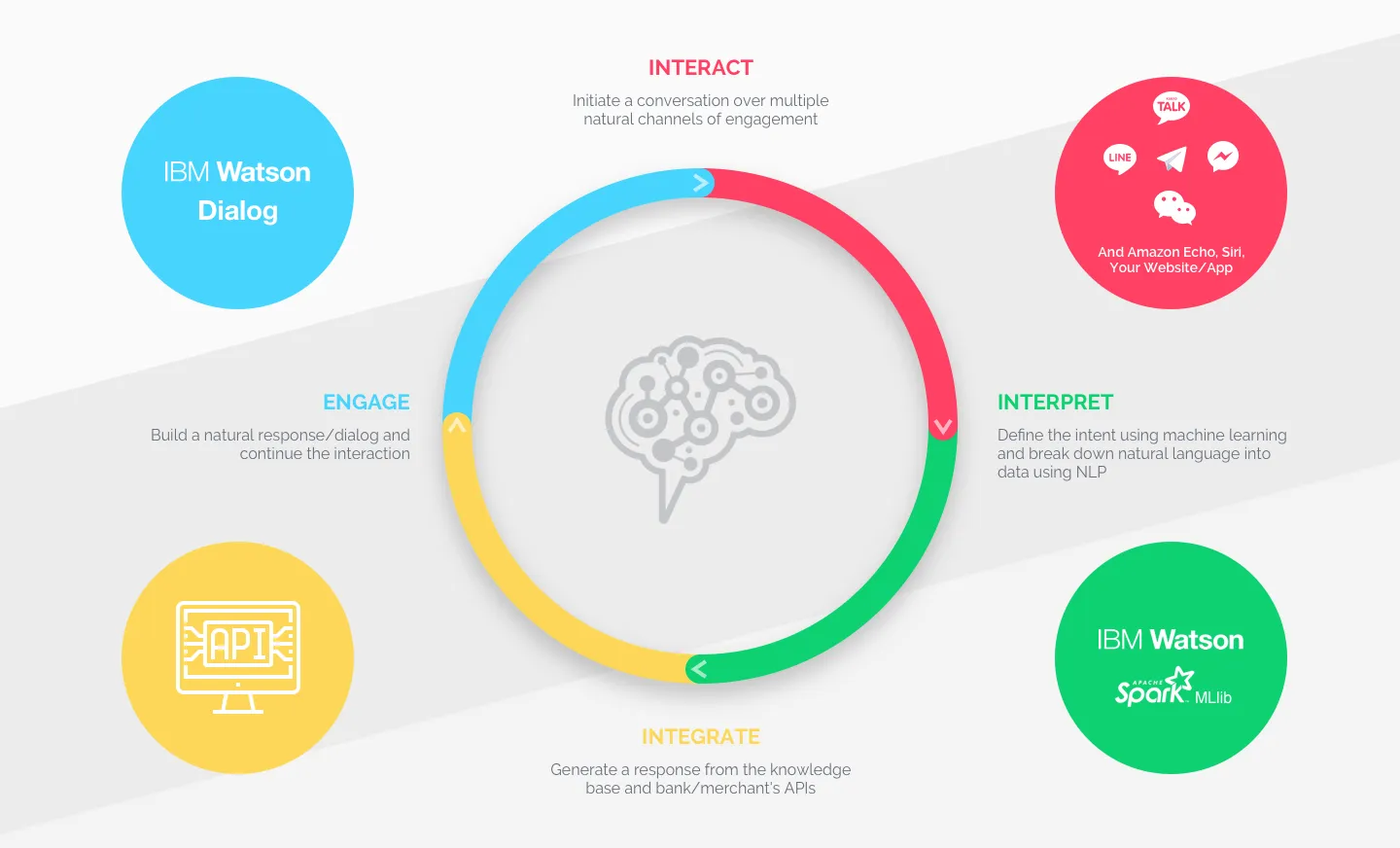

FinTech offerings are either already facing or would inevitably face the issue of personal advice that is possible only in physical outlets. To overcome these issues, tech giants such as Google, Microsoft, Facebook, and Amazon, as well as some tech upstarts, are exploring new-age chatbots. These chatbots are powered by AI, deep learning, and NLP to provide similar communication features as a human being. Active.ai is one such promising startup that aims to change the way financial services can be delivered across digital channels. A customer can seek advice, check financial information, and perform transactions using the chatbot service provided by their bank. The future of customer engagement (UX) is being architected on artificial intelligence, and Active.ai's intelligent and omnichannel platform enables financial services to engage with their customers over messaging bots, voice, and IoT devices. Active Intelligence Pte., is a Singapore-based FinTech company that aspires to be the go-to customer AI engagement platform for financial services companies such as banks, wealth managers, asset managers, etc. Partnerships At the back-end, they have partnered with IBM Watson for cognitive intelligence. And with Envestnet Yodlee for its data and API platform to deliver solutions to clients. They have built the platform ground up and are working towards filing multiple patents.

Funding The company raised $500,000 in a convertible note from Kstart-Kalaari Capital in May 2016. The company recently announced that it had raised $3 million in funding from IDG Ventures India and Kalaari Capital (announced first to LTP). This investment will support the rapid growth of Active.ai to advance its cutting-edge platform continuously and build out advanced AI features, enabling an increasing roster of clients to deliver a superior and engaging banking experience. Speaking on the Investment, Ravishankar, CEO and Co-founder, said, “Conversation is the new UX, and with banks opening up APIs, a new era of digital business is emerging. We are moving from 'mobile-first to AI-first,’ and Active.ai is the platform facilitating Banks to achieve that.”

"Active.ai is helping banks redefine their digital strategy for the future, bringing in automation and intelligent customer engagement to banking and payments. The company’s intelligent and built-for-banking technology uses advanced NLP and machine intelligence to enable customers (so that they have) natural dialogues over Messaging, Voice, or IoT devices,” added Shankar Narayanan COO and Co-founder. According to Sanat Rao, IDG Ventures, “43% of worldwide mobile phone consumers with a bank account use mobile banking today. The new generation of banking customers is looking for easy, secure and seamless interaction with their financial services provider. IDG Ventures India believes that AI will completely transform the banking industry, and we are very excited to partner with Active.ai to build the world’s largest conversational banking platform.”

According to Bala Srinivasa, Kalaari Capital, "Messaging-based mobile banking has become a strategic imperative for banks globally to enhance consumer experience and lower customer engagement costs. Active.ai is poised to tap into this large market opportunity with its chat and AI-powered mobile customer engagement solution. Kalaari is excited to back this founding team given their past track record, banking domain knowledge, and deep technology expertise."

In terms of customers, the company is engaged in discussions with 20+ banks in the APAC region to deploy its platform and expect at least 10 banks to go live on their platform over the next year. What's important to note is that AI-based chat assistant technology is getting commoditized. The real power of such an offering is to understand the workflows in banking and connect so well with the bank systems that the bot will actually be useful for a bank user. There are examples of how AI-based chat assistants don’t work if you don’t understand and imagine/include the way customers interact with banks usually (technology is just a tool). That is where the experience of the Active.ai team is important as it is a good balance between banking and tech. Another differentiating factor is the IP they have built (classifiers, NLP, integrations with multiple AI algorithms, etc.) and patents pending filing in some areas such as dialog synthesis and faster integration to existing systems.

To learn about Prove’s identity solutions and how to accelerate revenue while mitigating fraud, schedule a demo today.

Keep reading

Read the article: How Prove’s Global Fraud Policy Stops Phone-Based Fraud Others Miss

Read the article: How Prove’s Global Fraud Policy Stops Phone-Based Fraud Others MissLearn how Prove’s Global Fraud Policy (GFP) uses an adaptive, always-on engine to detect modern phone-based threats like recycled number fraud and eSIM abuse. Discover how organizations can secure account openings and recoveries without increasing user friction.

Read the article: Prove Supports Safer Internet Day: Championing a Safer, More Trustworthy Digital World

Read the article: Prove Supports Safer Internet Day: Championing a Safer, More Trustworthy Digital WorldProve proudly supports the goals and initiatives behind Safer Internet Day, a worldwide effort that brings together individuals, organizations, educators, governments, and businesses to promote the safe and positive use of digital technology for all, especially young people and vulnerable users.

Read the article: Prove’s State of Identity Report Highlights the New Rules of Digital Trust

Read the article: Prove’s State of Identity Report Highlights the New Rules of Digital TrustProve’s State of Identity Report explores why traditional point-in-time verification is failing and how businesses can transition to a continuous, persistent identity model to reduce fraud and improve user experience.