How Innovative Crypto Exchanges Are Upgrading Users to a Faster, Safer Experience

Cryptocurrency moves fast and runs 24/7 - so why do users often have to wait days or even weeks to be able to trade? In a recent webinar, I had the pleasure of tackling this very challenge with Paxful’s Chief Compliance Officer George Georgiades and Prove’s Fraud & Cybercrime Executive Advisor and VP of Client Experience Mary Ann Miller.

The short answer to this complex question is that crypto has an identity verification problem - it’s notoriously tricky to give new users a fast and seamless experience while also properly vetting that they are who they say they are. To complicate matters further, account takeover and other forms of crypto-fraud are rampant in this burgeoning industry.

Fortunately, the crypto industry is tackling this identity verification challenge head on and making real progress by leveraging phone-centric identity. I spoke with these two industry leaders about what kind of actions innovative cryptocurrency exchanges are taking to ensure that they’re offering fast and seamless onboarding and trading experiences while also mitigating fraud. Here’s an excerpt from our discussion:

(The follow has been edited for clarity and brevity)

Can you tell us a bit more about Paxful?

George Georgiades: Paxful is the largest P2P marketplace for cryptocurrency in the world. We bring buyers and sellers together so they can trade Bitcoin, Etherium, and Tether. We primarily focus on the unbanked and the disenfranchised, so our customers often don’t have access to traditional banks which requires flexibility when it comes to digital verification. Paxful is a global initiative and we want to serve the 100%, not just the top 1%.

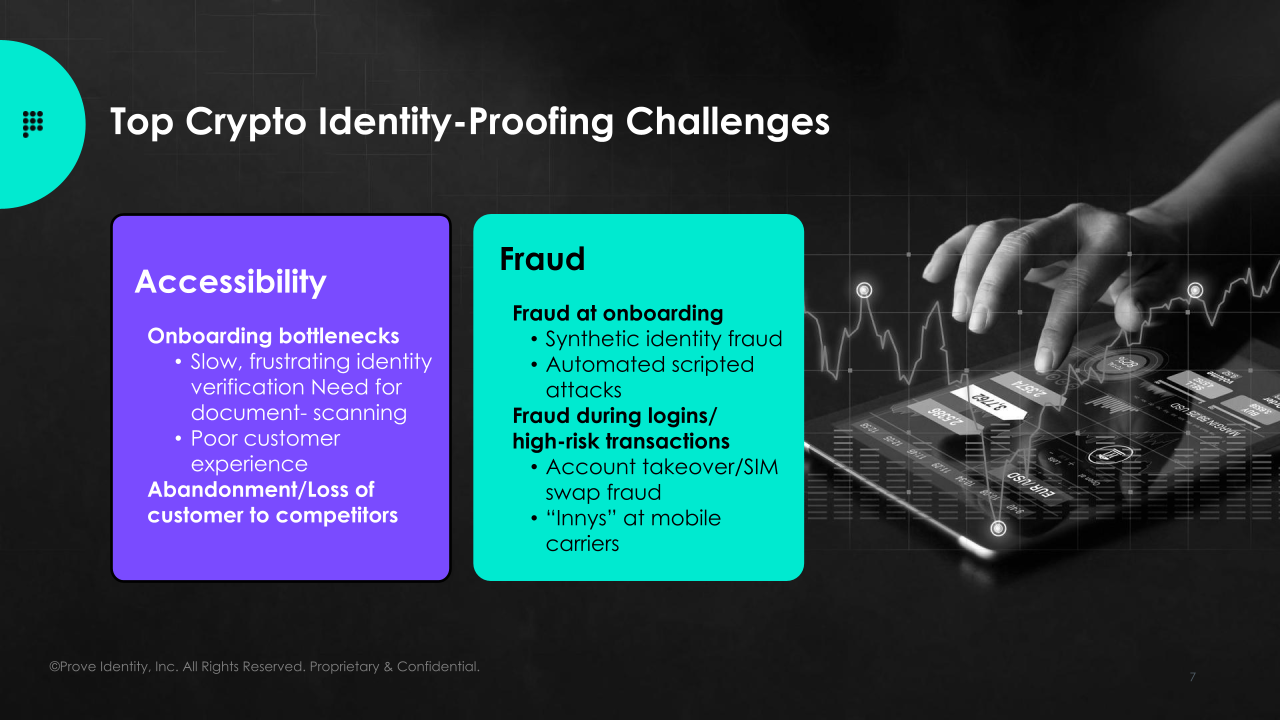

From your vantage point at Paxful, what are the top crypto identity-proofing challenges?

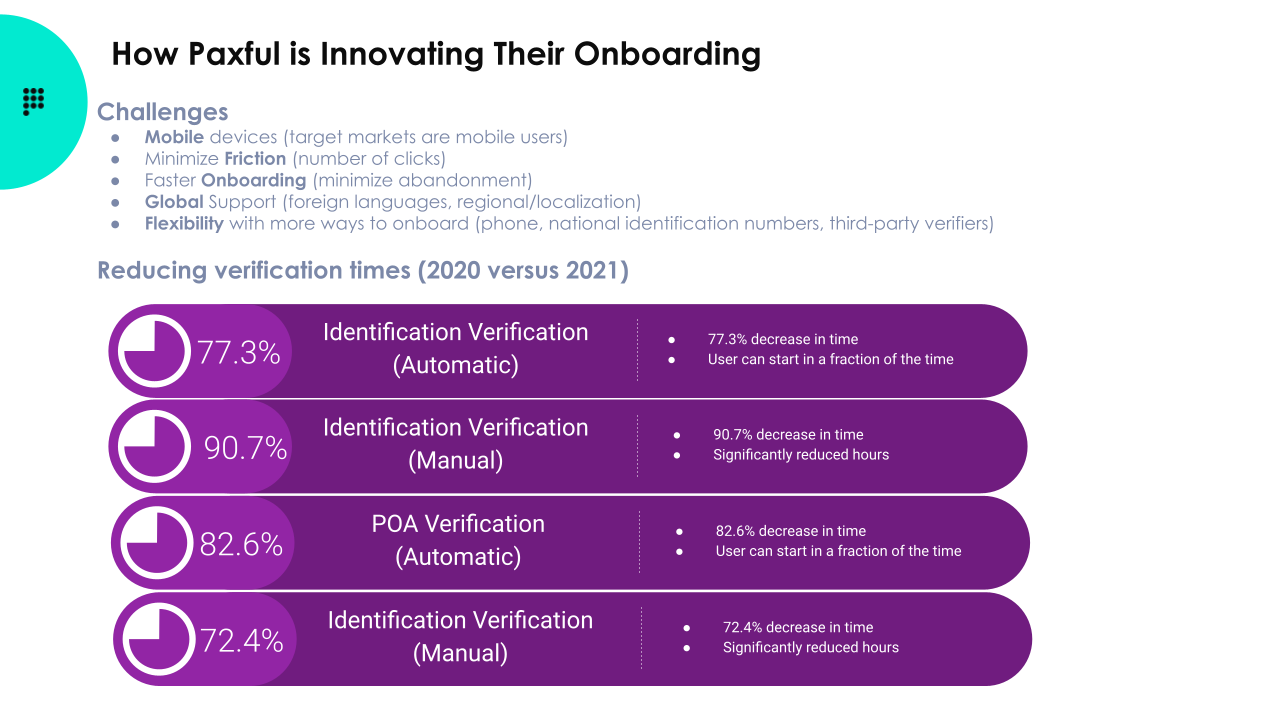

George Georgiades: Because our customers are not just in the United States or European marketplaces, there are unique challenges. In Africa, for instance, many of our users don’t use laptops. Instead, they are primarily smartphone users so being able to onboard and verify the identity of a user over a smartphone device alone is critical to Paxful.

Another typical identity-proofing challenge stems from the dueling interest between the compliance person and the product person. Ultimately, it boils down to the question: how do we reduce the number of clicks while still reducing fraud?

Finally, for an organization like Paxful, we need to have global support. We need to be able to localize and support government IDs from around the world. Ultimately, we need to be flexible in what we offer as identity verification methods.

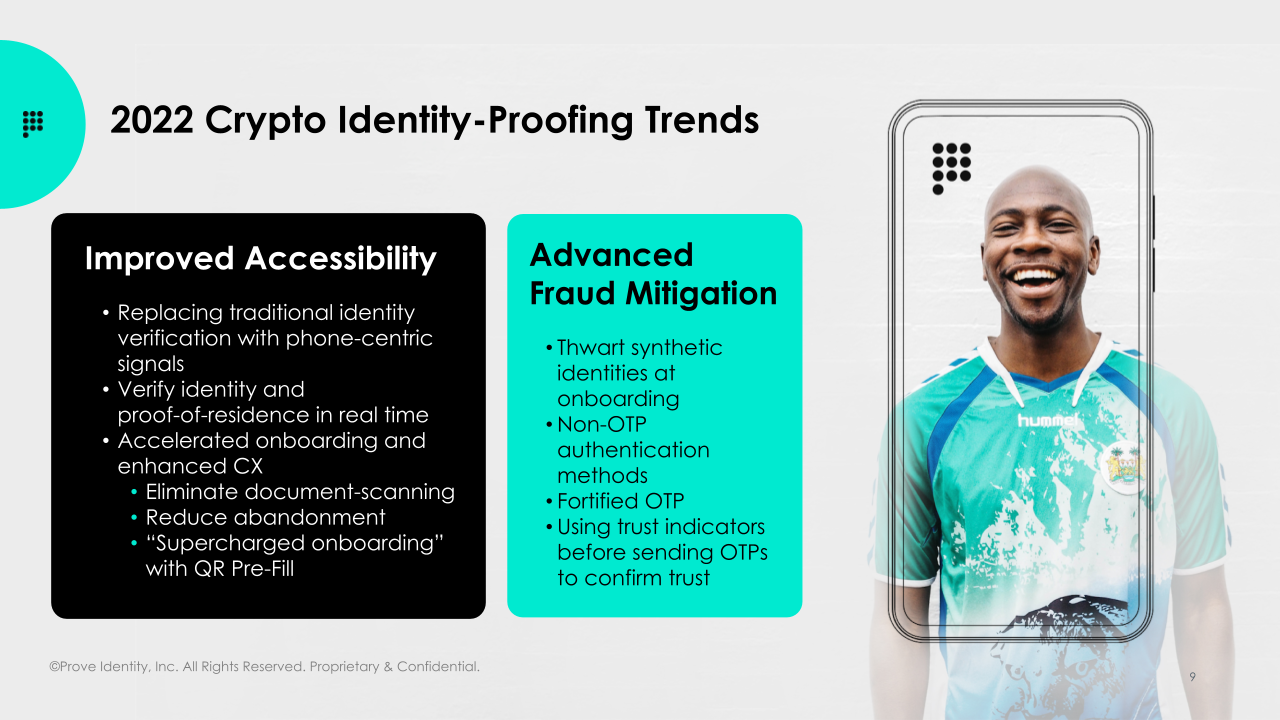

What are the major trends we’re seeing in the crypto identity-proofing space in general?

Mary Ann Miller: One trend worth mentioning is that increased vulnerabilities within the TELCOs are driving a surge in ATOs. Insiders at the TELCOs are being bribed to SIM Swap and allow bad actors to take over a victim’s account.

Another trend that has been covered extensively in the news is the creation of fake accounts via bots. As a result, we’re seeing more controls designed to protect the perimeter, improve identity proofing, and identify if an OTP has been SIM swapped. All of these controls are being fortified.

George, what are some of the results you’ve experienced at Paxful as a result of partnering with Prove?

George Georgiades: Before partnering with Prove, there were numerous challenges we faced. After our partnership, we were able to reduce the time it took to do identification verification by 77% so that increased how fast we can onboard a user and also how accurately we can do that. Manual verifications were decreased by 90% so that not only reduced friction for our users but it also reduced that man power needed to onboard.

Mary Ann Miller: These results underscore that strength of security and customer experience don’t have to be mutually exclusive. Anytime you can look at solutions that enable the business while also protecting the business and customer is ideal.

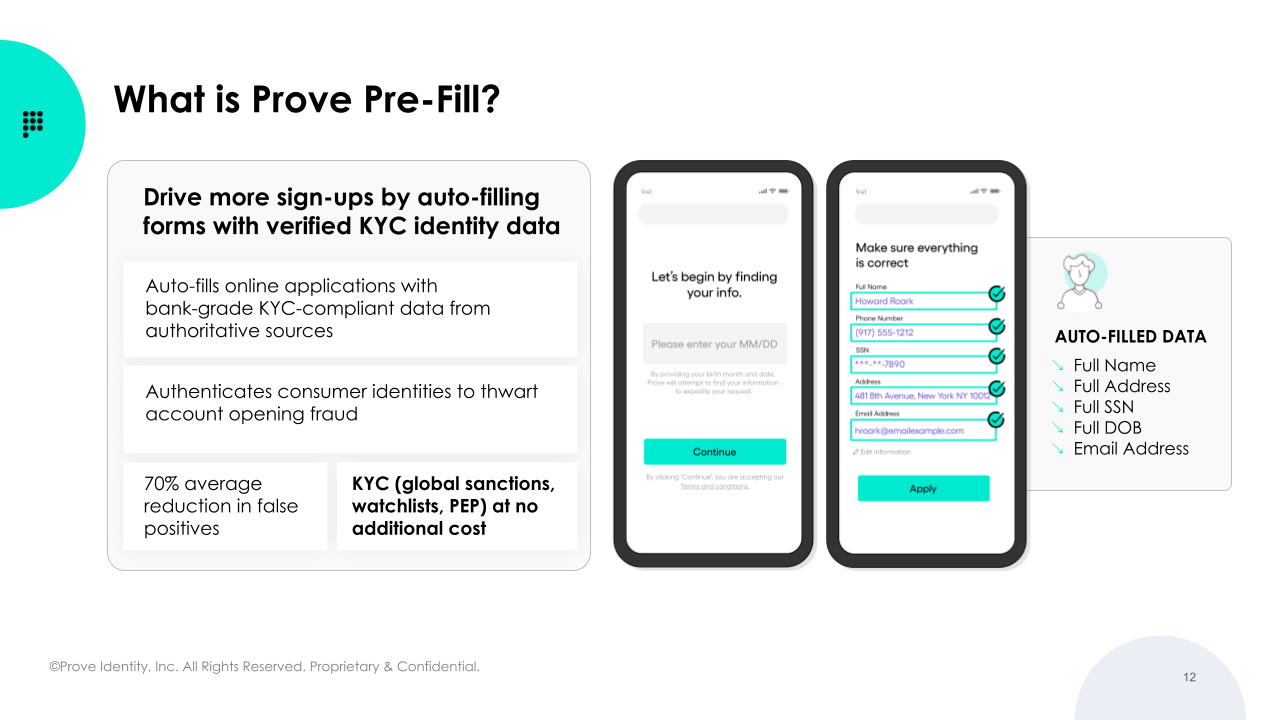

What are some of the latest enhancements to Prove Pre-Fill?

Joon: We all know that QR codes are pretty hot right now. At this point, there are hardly any menus anymore in New York City. And of course, we all remember that great Super Bowl advertisement. At Prove, we’ve taken the QR code to the next level by actually building the QR code into the Pre-FIll process. As soon as the customer scans the QR code (on TV, on a poster, etc.), the web page is redirected to the application process, and within 10 seconds the user can create an account with verified KYC information. Within the crypto context, this is really a paradigm shift away from progressive onboarding. With Pre-Fill paired with the QR Code, we can get more customers in the door and allow day-1 users to trade with much higher limits.

We hope you found these insights into crypto onboarding and fraud trends helpful. To watch the full webinar, click here.

Keep reading

Read the article: Why Prove Matters When Identity Data Leaks Become Critical Infrastructure Failures

Read the article: Why Prove Matters When Identity Data Leaks Become Critical Infrastructure FailuresAs large-scale data breaches expose billions of identity records, traditional identity verification and KYC models fail under automated fraud, making cryptographically anchored, persistent digital identity critical infrastructure.

Read the article: How Prove’s Global Fraud Policy Stops Phone-Based Fraud Others Miss

Read the article: How Prove’s Global Fraud Policy Stops Phone-Based Fraud Others MissLearn how Prove’s Global Fraud Policy (GFP) uses an adaptive, always-on engine to detect modern phone-based threats like recycled number fraud and eSIM abuse. Discover how organizations can secure account openings and recoveries without increasing user friction.

Read the article: Prove Supports Safer Internet Day: Championing a Safer, More Trustworthy Digital World

Read the article: Prove Supports Safer Internet Day: Championing a Safer, More Trustworthy Digital WorldProve proudly supports the goals and initiatives behind Safer Internet Day, a worldwide effort that brings together individuals, organizations, educators, governments, and businesses to promote the safe and positive use of digital technology for all, especially young people and vulnerable users.