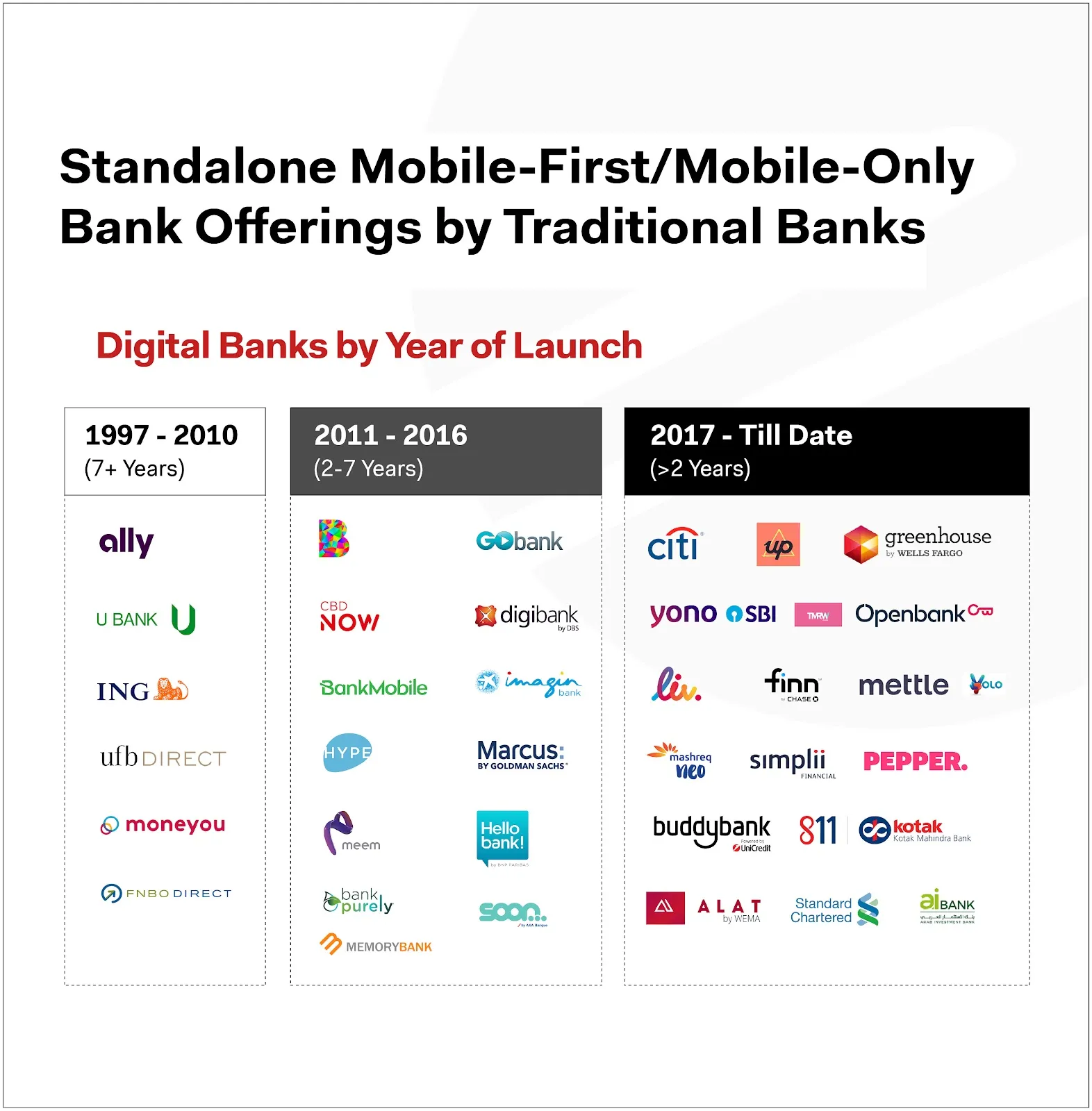

Infographics Analyzing Incumbent Banks’ Standalone Fresh Mobile-First Offerings

Today’s story is about digital banking. There are many ways top honchos at banks think about embracing digital and using FinTech to their advantage. It could be buying FinTechs, accelerator/innovation programs, or even digital transformation of the existing banks, amongst other options. One of the ways in which some of them have crafted their digital strategy is by building a separate digital bank of sorts. We analyzed online/virtual/digital banking initiatives/apps created by traditional banks worldwide. Our attempt here is to provide research-based insights and highlight digital banking initiatives.

Important note: We are not including challenger banks like Revolut, Monzo, Starling, N26, and others like them. That is for another day/article. Instead, this analysis focuses on traditional banks’ fresh online or app-based offerings.

Firstly, digital/online banks aren’t a new trend. Since the 1990s, incumbent banks have launched online-only banks that offer banking services via internet/mobile/tele-network channels. ING is one of the banks that launched a direct banking service called ING Direct to customers with a branchless model. In Canada, it was very successful, and ING expanded its services to other countries, including Australia, the United States, France, Spain, Germany, Italy, and the United Kingdom.

Here are some traditional banks & FIs that have launched their own digital banks:

- Goldman Sachs launched a digital bank under the brand name ‘Marcus by Goldman Sachs.’ It is an online platform that offers no-fee personal loans and high-yield savings accounts. It also recently launched its services in the UK and opened more than 50k accounts as of October 2018.

- BNP Paribas launched Hello bank! in France in 2013. It is a mobile-first bank offering account services and other banking products. The bank operates in six countries: France, Germany, Italy, Belgium, Austria, and the Czech Republic. It has opened around 3 million accounts to date.

- DBS Bank launched digibank, which provides its banking services mainly on a smartphone app. digibank was first set up in India and currently serves 2 million+ accounts holders. DBS Bank has recently launched its operations in Indonesia.

- Customers Bank launched BankMobile, which offers no-fee savings and checking accounts for underbanked and middle-income households. Since its inception, it has opened around 2 million accounts from nearly 800 colleges and universities across the US. The bank claims that it opens about 300,000 new accounts each year.

Here is the region-wise breakdown of digital banks:

In North America, banks/FIs that have launched their own standalone digital banks are Wells Fargo (Greenhouse), JP Morgan & Chase (Finn), Customers Bank (BankMobile), Green Dot Bank (GoBank), Goldman Sachs (Marcus), CIBC (Simplii Financial), Capital One (Capital 360)*, Scotiabank (Tangerine)**, etc.

In Europe, the banks/FIs that have started their own digital banks are BNP Paribas (Hello bank!), Unicredit (buddybank), Banco Santander (Openbank), Clydesdale Bank & Yorkshire Bank (B), ABN Amro (Moneyou), CaixaBank (imaginBank), OTP Group (Touch Bank), etc.

In the Middle East, the top banks/FIs that have set up their own digital banks are Mashreq Bank (Mashreq Neo), Emirates NBD (Liv), Bank Leumi (Pepper), Gulf International Bank (meem), and Commercial Bank of Dubai (CBD Now).

In Asia & Africa, the banks/FIs that have launched their own digital banks are DBS (Digibank), State Bank of India (Yono), Kotak Bank (Kotak 811), CITIC Bank and Baidu (aiBank), WEMA Bank (ALAT), Halyk Bank (Altyn-i), and Standard Chartered Bank.

In Oceania, banks/FIs launched their digital banks are Bendigo and Adelaide Bank (Up) and NAB (Ubank).

**ING Direct’s US division was acquired by Capital One in 2012 and was rebranded as Capital 360.

***ING Direct’s Canada division was acquired by Scotiabank in 2012 and was rebranded as Tangerine.

Update: We had previously missed out on including Hype, a digital bank Banca Sella launched in Italy. A representative from the bank got in touch with us, and we have now updated the infographics.

To learn about Prove’s identity solutions and how to accelerate revenue while mitigating fraud, schedule a demo today.

Keep reading

Read the article: Why Prove Matters When Identity Data Leaks Become Critical Infrastructure Failures

Read the article: Why Prove Matters When Identity Data Leaks Become Critical Infrastructure FailuresAs large-scale data breaches expose billions of identity records, traditional identity verification and KYC models fail under automated fraud, making cryptographically anchored, persistent digital identity critical infrastructure.

Read the article: How Prove’s Global Fraud Policy Stops Phone-Based Fraud Others Miss

Read the article: How Prove’s Global Fraud Policy Stops Phone-Based Fraud Others MissLearn how Prove’s Global Fraud Policy (GFP) uses an adaptive, always-on engine to detect modern phone-based threats like recycled number fraud and eSIM abuse. Discover how organizations can secure account openings and recoveries without increasing user friction.

Read the article: Prove Supports Safer Internet Day: Championing a Safer, More Trustworthy Digital World

Read the article: Prove Supports Safer Internet Day: Championing a Safer, More Trustworthy Digital WorldProve proudly supports the goals and initiatives behind Safer Internet Day, a worldwide effort that brings together individuals, organizations, educators, governments, and businesses to promote the safe and positive use of digital technology for all, especially young people and vulnerable users.